10 year balloon loan

Loan amount 100000. They often have a lower interest rate and it can be easier to.

Balloon Payment Definition Example Investinganswers

It is the 30 years which you would enter below.

. However the bank doesnt want to. The 15-year balloon has become popular for a completely different purpose. Balloon mortgages are mortgage loans that are amortized over 20 to 30 years.

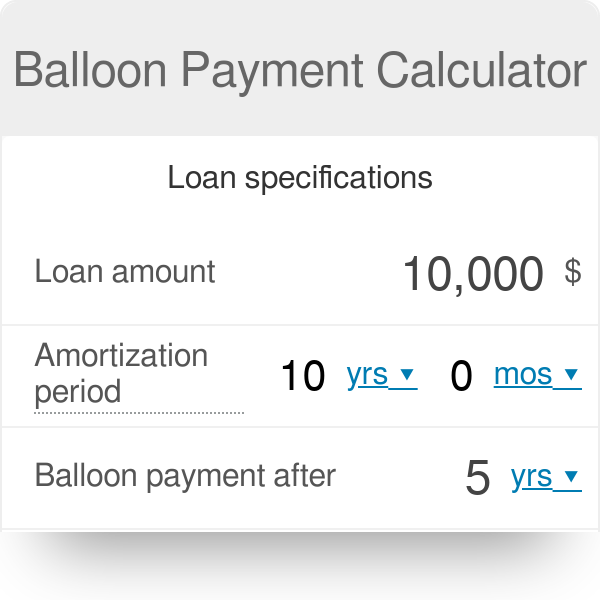

In contrast a fully amortized loan is. After filling our balloon payment calculator with the information in this example we will receive all the necessary details immediately. Balloon mortgages allow qualified homebuyers to finance their homes with low monthly mortgage payments.

A common example of a balloon mortgage is the interest-only. At the end the borrower must make a large payment known as a balloon payment in order to repay. Balloon Mortgages compared to other types of.

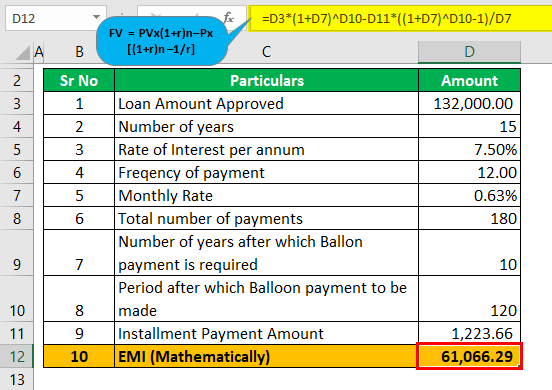

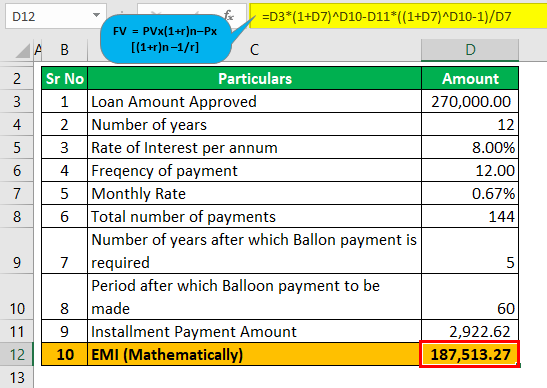

The loan payment is calculated such that after 20 years of payments the loan will be paid in full hence the loan is fully amortized in 20 years. A balloon payment is a larger-than-usual one-time payment at the end of the loan term. Usually the loan is refinanced when the balloon payment comes due.

If you enter the year count we will automatically calculate the final payment. Many borrowers putting less then 20 down. Most balloon loans are typically for a 5 or 10 year repayment period with a 30 year amortization term.

A balloon loan comprises a stream of constant payments followed by a large payment at the end which is called the balloon payment. Seven-year balloon mortgages seem to be the most common but youll also find five-year and 10-year repayment terms. But at the end of that five- or 10.

A balloon mortgage is structured as a typical 30-year principal- and interest-payment loan for a set period of time say five or 10 years. These loans are only good for three five seven or ten years. Using Bankrates balloon mortgage calculator.

This depends on the specific loan. Lets say you take out a 250000 balloon mortgage at 35 percent amortized over 30 years and with a loan term of seven years. For example a 3000k loan with 5 interest and amortization set to interest only would have a payment of 12500month.

This free balloon mortgage calculator will help you calculate your final balloon payment amount for a mortgage with a balloon payment. One kind of balloon loan a five-year balloon loan has a loan life of 5 years. A balloon mortgage is usually rather short with a term of 5 years to 7 years but the payment is based on a term of 30 years.

When the term comes up the. They are used as the second mortgage in a piggyback arrangement. A 30 year amortization with a 10 year maturity means you make payments just like a 30 year fixed rate mortgage for 10 years-but actually your loan matures after 10 years.

If you enter the final payment then you can see the. If you have a mortgage with a balloon payment your payments may be lower in the years.

Balloon Loan Calculator Single Or Multiple Extra Payments

How Balloon Mortgages Work

Balloon Payments Meaning Mortgage Pros Cons What Is It

Balloon Balance Of A Loan Formula With Calculator

Balloon Loan Calculator Single Or Multiple Extra Payments

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

Lesson 10 Video 2 Balloon Payment Loan And Interest Only Loan Youtube

Balloon Loan Calculator Single Or Multiple Extra Payments

How To Calculate A Balloon Payment In Excel With Pictures

Balloon Maturity Definition Example Investinganswers

Balloon Loan Definition

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

How Balloon Loans Work 3 Ways To Make The Payment

Balloon Payment Calculator

Balloon Payment Mortgage Video Mortgages Khan Academy

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Balloon Mortgage Calculator How To Calculate Balloon Mortgage